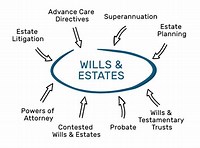

If you’ve been following our blog post for quite a while now, you’re probably aware that we’re encouraging every adult to start their estate planning as early as they can. That way, they can secure their future and live a successful life. But while we were at it, we failed to provide you with the necessary steps on how to get started – apologies for that. We want to make it up so here are five simple steps to establishing a successful wills and estates Darwin plan:

Step 1: Write Your Will

Wills are written documents that states who you want to inherit your property. It will then mention the names of different people whom you want to inherit your assets, properties, and even your wealth. If you have underage children, you can also appoint a guardian in case something happens to you and your spouse. You can edit your will anytime you want.

Step 2: Consider Getting a Trust

Holding your property in a living trust will enable your survivors to receive your properties and wealth without having to go through a probate court. Not putting your assets in a trust will only make it hard for your family to retrieve it as they’ll have to go through an expensive and time-consuming process.

Step 3: Create Health Care Directives

If you are suffering from a chronic pain or illness, or you want to make sure that you’re well taken cared of when you’re no longer able to make medical decisions for yourself, writing out a health care directive will do the trick. Health care includes a declaration, which is similar to a living will, and a power of attorney for health care. The latter gives a person, whom you will choose, the ability to make decisions on your behalf, granted that you can no longer make them on your own.

Step 4: Make a Power of Attorney for Your Finances

Give a person you trust the authorisation to handle your finances and property with a durable financial power of attorney. It will be essential for when you become unable to manage your finances due to illness or incapacitation. While the person you will name will be called an agent or attorney, they don’t necessarily have to be one.

Step 5: Safeguard Your Children’s Property

Name an adult to manage any property and wealth that your minor children may inherit from you. That way when you die before they turn 18, they and their would-be assets will be taken cared of. That’s why it’s essential that the person who will hold your children’s inheritance will also be their would-be guardian.

By following these straightforward steps, you can successfully establish a wills and estates Darwin plan that can secure the future. If you want to simplify things, hire our estate planning attorney today! Call our hotline now to schedule an appointment.